3 Key Trends for Media Companies from Ofcom’s Communications Market Report

The Ofcom Communications Market Report is a pretty good bellwether of changing consumer habits. And, like boats reacting to the tide, those changing habits dictate how media companies will act over the next few years, as they change their priorities to benefit from shifting audience attention.

Here are three key takeaways from the latest report that shine a light on where media companies will lie over the next few years.

UK broadcaster revenue takes a hit

In 2017 total broadcaster revenue fell 4 percent year on year, to £13.6 billion. OFCOM attributes this to an overall decrease in the amount of linear television watched by the public. In turn, it states this is due to OTT services like Netflix and Amazon Prime having a foothold in 40 percent of UK households, and the fact that younger generations are more habituated to watching content on YouTube. In fact, Ofcom states that young adults between 16-24 are now watching an hour of content each day on YouTube alone.

For many media companies, that’s seen as an opportunity to reach younger, lucrative audiences with advertising and ecommerce. But for the traditional broadcasters, many of which have been caught on the back foot with this rapid transition to OTT, it’s disruption. The report states that ‘Children’s viewing fell by 15 percent in 2017 to an average of 1 hour 24 minutes, and 16-24s’ viewing fell by 12 percent to an average of 1 hour 40 minutes’.

Despite the predictions from the Advertising Association and Warc that television adspend is set to have a resurgence, those broadcasters will be looking at the US market for guidance where, if anything, those trends are more pronounced. Television adspend in the US has plateaued and, as with every market undergoing digital disruption, the broadcasters are playing catch-up to the OTT services (or just outright buying them, in some cases).

Smartphones define the modern internet

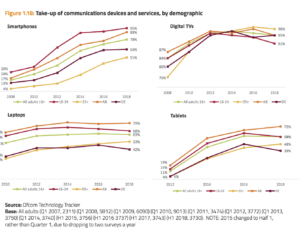

Unsurprisingly for anyone who owns a handset, the smartphone has come to thoroughly dominate modern media consumption. Just over a decade after the launch of the first iPhone, almost four fifths of all UK adults have personally used a smartphone, and 62 percent of all time spent online was spent on one.

While the big area of growth over the past few years has been in digital video (related to the first point), social networks are undeniably the biggest gainers in terms of where people are spending time on smartphones. The Ofcom report points out, for instance, that almost a third of people use their smartphones to access social networks even while they commute, and half of respondents said they check social networks on their phones more regularly than they did two years ago.

However, past content and networking, utilities are becoming much more widely accessed on smartphones. The report notes that fully 84 percent of all adults agreed with the statement: ‘online shopping and online banking have made my life easier’.

It might be a fair way off yet in the West, but you only have to look to the Tencent-owned WeChat in China to see where the future lies: A mixture of social network and utilities app that lets people pay bills, send money and spend huge amounts of money on minigames. The smartphone is only going to become more integral to audiences’ lives. The real question for media companies is – how can they take advantage of that?

Radio resilience and beyond

Despite all that disruption, the Ofcom report plainly states that radio is proving resistant to disruption – perhaps due to the malleability of its content: “Nine in ten adults in the UK listen to radio every week for an average of nearly 21 hours a week, and 75 percent of all audio listening is to live radio.”

In part that 75 percent figure is due to the widespread availability of devices that can receive live radio, from traditional wireless sets to smartphones with access to data or WiFi to smart speakers. But in the first quarter of 2018, for the first time, over a half of all listening was done on purely digital devices, suggesting the balance is tipping over to the more high-tech end of the spectrum. One in ten listeners to live radio, for instance, now does so via a smart speaker.

Additionally, the malleability of audio content both in terms of form (not having the issues surrounding making compatible video) and function (being a passive medium that can be listened to as a secondary activity) mean that ‘audio’ is converging as a medium. Everything from music to talk shows to news to podcasts are now available on the same devices, which contributes to this resilience of radio. Podcasts especially are a boom mini-industry, with the report stating that:

“According to RAJAR, the number of UK adults who listen to a podcast each week increased from 3.2 million (7 percent of adults) in 2013 to 5.9 million in 2018 (11 percent of adults). This increase is across all age groups, but the steepest growth in the past year was among 15-34 year-olds.”

And, because of the relatively low cost-of-entry to launch podcasts and that increased attention from audiences, some media companies are already reaping the benefits. Panoply, for instance, the podcast-focused spinoff of Slate, saw advertising revenues rise 36 percent in 2017 over 2016 and were expected to rise still further, accounting for fully a quarter of Slate’s overall revenue.

Given that many media companies are desperate for those new lucrative audiences, you can expect that we’ll seen Panoply-esque endeavours launched from UK publishers and broadcasters alike over the next couple of years.

Martin Tripp Associates is a London-based executive search consultancy. While we are best-known for our work across the media, information, technology, communications and entertainment sectors, we have also worked with some of the world’s biggest brands on challenging senior positions. Feel free to contact us to discuss any of the issues raised in this blog.