NME, Sports Illustrated and the future of magazine publishing

The news recently broke that US magazine publisher Meredith was selling off another of its titles, part of a long-running effort from the media company to focus more on its core areas of interest. What was unusual about this latest piece of news – that venerable Sports Illustrated is being offloaded for $110 million – is the identity of the buyer.

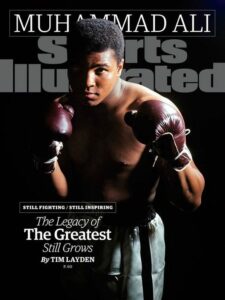

Rather than being another media company, which would have made this just another entry in the ledger of media consolidation, Sports Illustrated is being sold to Authentic Brands Group. Other than having a name that sounds made up on the fly, Authentic Brands Group is best known for its brand development operations – it oversees the management of parts of the Elvis Presley and Muhammad Ali estates, for instance.

The Drum reports Authentic Brand Group’s CEO Jamie Salter as saying: “Sports Illustrated is not just a magazine. It’s really a platform and it really stands for something that is hard – when you’re building brands – to get: It has authenticity. It has authority. It has respect. To earn that with a consumer, it’s not easy, right? Consumers are tough.”

That authority – and the recognition that comes along with the Sports Illustrated brand – is at the heart of this new arrangement. Authentic Brands Group plans to use its new ownership of the name to promote a range of products from medical clinics, sports training and gambling. The magazine itself, which will continue to be produced by Meredith in a two-year licensing deal, will effectively act as a branded content play for these products, even if nothing about the editorial itself actually changes.

We’ve already heard the obvious concerns about the sale, that it will ultimately force the editorial team at Sports Illustrated to cater to the whims of Authentic Brands Group, promoting whichever of its new products needs hawking this week. That it will effectively act as a catalogue with a smattering of unrelated articles. Those fears are lent weight by the fact that this will be the first time that ABG has licensed a media property, with most of its previous investments being around celebrities and fashion.

More pressing is the worry that, as a result of the above issues, the brand will instantly become devalued. Audiences typically do not feel as strongly affiliated with brands they know are only trying to sell them something (even if that has always tacitly been the arrangement), and people won’t pay as readily for what amounts to a sales booklet as they would for a truly editorially independent magazine.

It’s especially relevant given that this is not the first such example of a non-traditional media company buying up a well-known and respected magazine brand to piggyback off its authenticity. Last month, TI Media sold NME and Uncut off to Singapore-based music platform BandLab Technology. While BandLab already has media holdings – having previously purchased Guitar.com and Musictech – the aims and terms of the deal are very similar to that of the Sports Illustrated sale. The NME and Uncut teams will continue to be based in the TI Media building, and the language used around its sale also indicates a desire to ride the brands’ authenticity on the part of the purchaser. As The Drum’s Rebecca Stewart reports:

“The company says it’s buying the quintessentially British NME to ‘grow out a major global music media business’”.

In both cases the benefits to the purchaser are obvious: it grants them access to established audiences with proven interests in a vertical, and a new platform on which to target ads towards their core products. Moreover, it allows them to trade on the brand name itself, which boosts the recognition factor for the newly-affiliated products. For both publishers, too, there are readily apparent reasons to sell off the titles – it gives them a much-needed cash boost and divests them of titles that fall outside their usual purview.

What’s most interesting is what this says about the future of magazine brands. For years it seemed that media consolidation would lead to most titles existing under a few super publishers, with the least successful of the stables periodically being culled. That will likely continue to be the case for more generalist lifestyle magazines, simply because there are very few that have a recognisable brand name worth slapping onto premium products.

But if companies that aren’t traditional publishers begin purchasing brands in earnest, either because of synergy with their existing products like BandLab and NME, or to leverage the recognition of the brand name, it’s possible that magazine brands themselves could end up in a far more secure position at non-publishers than at publishers. Only time will tell.

Chris Sutcliffe

Martin Tripp Associates is a London-based executive search consultancy. While we are best-known for our work across the media, information, technology, communications and entertainment sectors, we have also worked with some of the world’s biggest brands on challenging senior positions. Feel free to contact us to discuss any of the issues raised in this blog.