The changing economics of news video

With the news that Facebook is betting upon news video to help grow its Watch platform, there has been a fundamental shift in the economics of video news production. Where once entertainment content was used to attract customers and audiences, against whom the broadcasters could sell adverts, the nature of video content has become somewhat flattened and undifferentiated.

That’s due to any number of things – unbundling, the rise of on-demand digital video on YouTube, Twitch and Facebook, and the overall conflation of ‘news’ and ‘entertainment’ that has come with homegrown news and analysis on those platforms.

But news content is expensive to produce and, crucially in the age of Netflix and Hulu, has an incredibly short shelf life that doesn’t necessarily justify the cost of production relative to the number of potential subscriptions sold. While there are nuances there – current affairs-led shows like Netflix’s The Joel McHale Show with Joel McHale are effectively weekly news shows – for the most part regular news shows don’t currently have a place on streaming services. Until there is a rise in the reported 7% of UK viewers paying for online news content, it’s unlikely that will change. Netflix’s business model relies on evergreen content, as we wrote about here, and not flash-in-the-pan news agenda-led shows.

It’s telling that Vox’s announcement of its own ‘news’-type Netflix show ‘Explained’ specifically points out that it was designed to be anti-news, to be evergreen explainers more akin to mini documentary movies than more traditional news content:

“As the old journalism adage goes, the first three letters of “news” spell “new.” But we believed there was a need for more deep reporting on the questions, forces, and ideas that rarely find themselves in the bright light of the daily news cycle.”

However, it seems as though broadcast channels that are specifically news-led – and thus are already shouldering the production costs and whose audience already looks to them for digital video news – might be more inclined to get into the digital video news game. For instance, Variety recently reported on NBC’s plans for original NBC News and MSNBC-branded news content on its own dedicated streaming services:

“NBC News Digital is expected to test some programs this summer, thus [sic] person said.

“Under current plans, the new outlet will offer all original video content, not pick-ups of programs that already exist on NBC or MSNBC, this person said. Talent to be deployed is under discussion.”

So, why would Facebook be prioritising news content for its Watch platform? And why would the partner broadcasters announced as part of that effort – including CNN, Fox News, ABC News and Univision – be so keen to jump into bed with a platform that isn’t just a direct competitor for audience time but also has burnt its bridges with other publishers?

The second part of that question is easier to answer: As we’ve spoken about before on this blog, television ad spend appears to have plateau’d, in the US at least. The big networks with whom Facebook has partnered are just as keen for new revenue sources as paper publishers were back in 2015, and if nothing else Facebook has proven able to convince new partners that teaming up is mutually beneficial.

But why would Facebook look to co-fund expensive news content that has a shortened shelf-life? And what does it say about the changing economics of digital news video?

For one thing, it suggests that Facebook is seeing similar trends on its Watch platform as YouTube is seeing on its own platform. Namely, that both live content and (to some extent, as a YouTube executive told me at a Working With Google event last week) news content are growth areas, and that news content from semi- or wholly-controversial news stations like CNN and Fox News are likely to deepen engagement in the areas Facebook is prioritising.

Additionally, as we saw with BuzzFeed’s entry into the news space, publishing serious content of that nature has a halo effect that has a beneficial impact on how Facebook can approach potential advertisers. Brands that might not necessarily have been happy having ads appear against Facebook’s other Watch properties might think again.

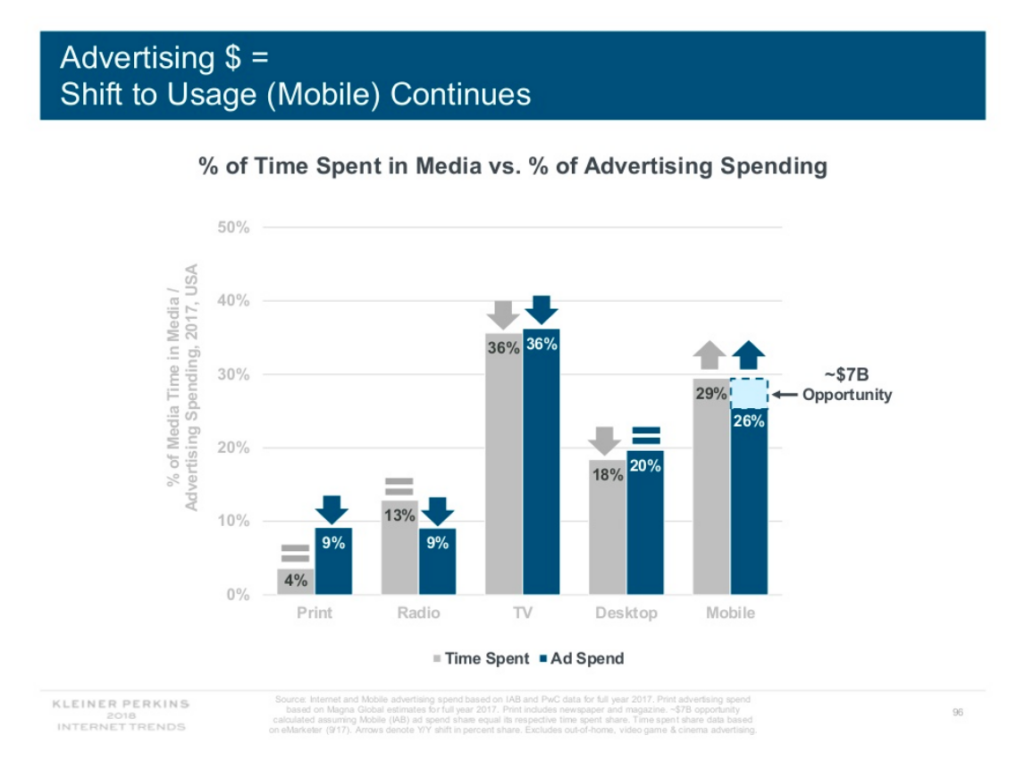

Also, the trend towards the amount of digital video content consumers are watching isn’t slowing – and is still accelerating on mobile. As the latest Mary Meeker internet trends report demonstrates, there is still an $8 billion opportunity for mobile ad spend – and Facebook wants to own it. News content, far from being subsidised by other entertainment content on television, is now being used as bait to attract audiences and advertisers onto new platforms.

Chris Sutcliffe

Martin Tripp Associates is a London-based executive search consultancy. While we are best-known for our work in the TMT (technology, media, and telecoms) space, we have also worked with some of the world’s biggest brands on challenging senior positions. Feel free to contact us to discuss any of the issues raised in this blog.